What Is the Exness Calculator?

Consider the Exness Calculator your personal trading mathematician. This advanced web tool handles complex financial computations instantly for every asset available on the platform.

Trading success relies on accurate data rather than emotional decisions. Knowing exactly how much capital you need for a position or what profit a 40-pip move generates creates the foundation for consistent results. The calculator converts market fluctuations into precise financial figures.

This tool integrates seamlessly with Exness trading specifications. It automatically recognizes leverage limits, instrument details, and current market prices. Everything updates in real-time without requiring manual input or adjustment from your side.

Types of Calculations You Can Do

Professional trading requires multiple calculation types working in harmony. The calculator provides these essential mathematical functions in one convenient location for comprehensive trade analysis.

Margin serves as your trading deposit that secures leveraged positions. Incorrect margin calculations often result in forced position closures or missed trading opportunities when accounts lack sufficient funds.

Leverage amplifies your market exposure while requiring less capital upfront. At 1:500 leverage, $200 can control $100,000 worth of currency. Reduce leverage to 1:100, and you need $1,000 for identical exposure. The Exness margin calculator processes these relationships instantly.

Various instruments demand different margin levels based on their volatility and market liquidity. Major currency pairs typically require lower margins than exotic pairs or volatile commodities. The calculator applies appropriate margin rates automatically for each instrument category.

Pre-calculating potential outcomes distinguishes professional traders from gamblers. Understanding profit potential before entering positions helps validate whether trades meet your strategic objectives.

The system handles currency conversions effortlessly regardless of your trading pair or account denomination. Trade CAD/JPY with an EUR account? The calculator manages conversions seamlessly, displaying results in euros without additional steps required.

Smart traders utilize profit estimation to verify their risk-reward ratios. When your strategy targets 3:1 reward-to-risk, the calculator shows precisely where to place profit targets to achieve that mathematical relationship.

Trading fees accumulate rapidly and can eliminate profits from otherwise successful strategies. Understanding these expenses beforehand protects your trading capital and strategy performance.

Account types feature different fee structures that impact your total trading costs. Raw spread accounts charge commissions per trade but offer tighter spreads. Standard accounts include fees within wider spreads. The calculator reveals actual trading costs for proper comparison.

Timing affects your overnight charges significantly. Certain currency pairs provide positive swap income, adding to your profits over extended periods. Others impose holding costs that can exceed trading gains. The calculator quantifies these impacts accurately.

How to Use the Exness Margin Calculator

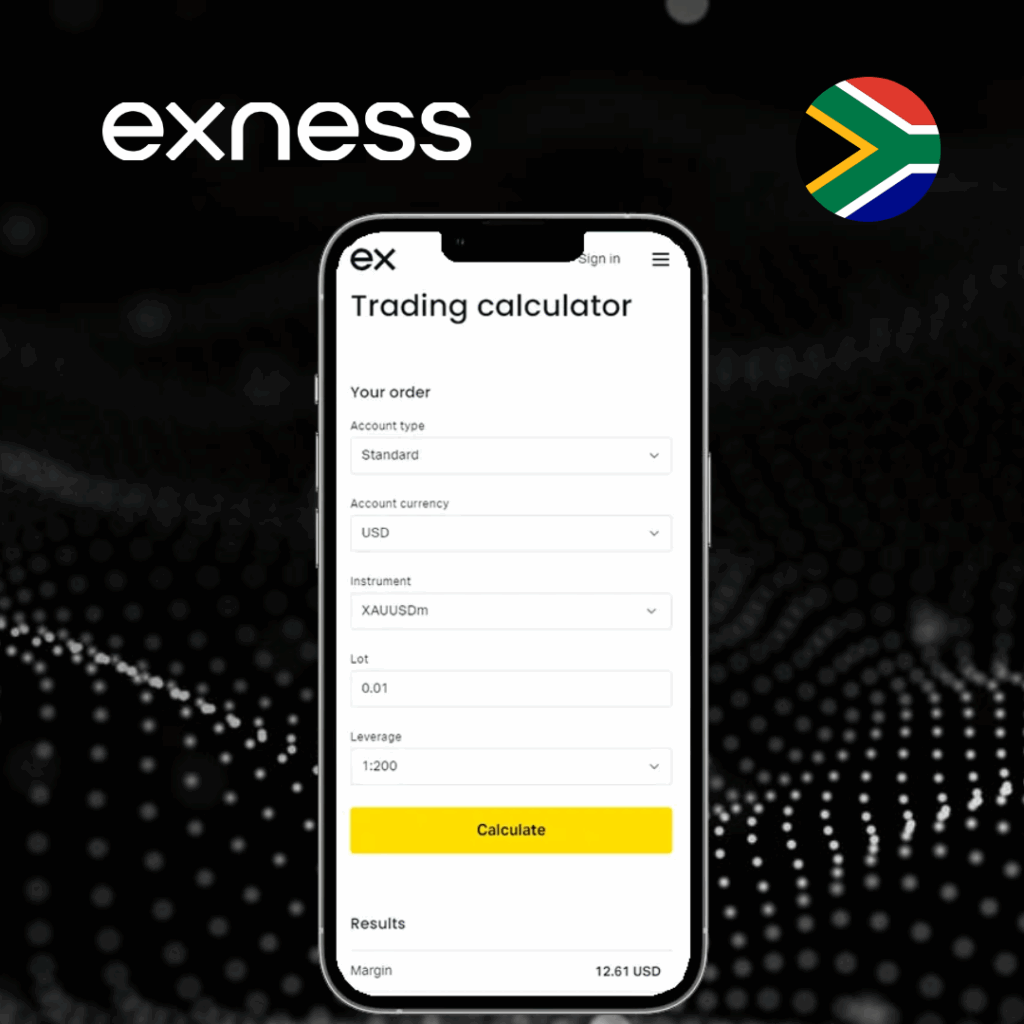

Operating the calculator requires minimal learning time. The intuitive interface emphasizes speed while maintaining calculation accuracy for professional trading needs.

Input Parameters (Leverage, Lot Size, Pair)

Begin by selecting your desired instrument from the comprehensive menu covering forex pairs, commodities, stock indices, and cryptocurrencies. Popular trading assets appear prominently for quick selection during active market periods.

Set leverage to match your actual account configuration exactly. This crucial step ensures margin calculations reflect your real trading environment. Incorrect leverage inputs produce misleading results that can compromise your position sizing strategy.

Determine lot size according to your risk management principles. Standard lots (1.0) generate $10 per pip on major pairs. Mini lots (0.1) produce $1 per pip. You can input any lot size, including decimal values like 0.85 lots.

Choose your account currency to ensure all results appear in your preferred denomination. The system supports major currencies with automatic conversion calculations updated continuously.

Example Calculation Step-by-Step

Let’s examine a NZD/USD trading scenario:

- Currency pair: NZD/USD

- Trade volume: 0.8 lots

- Account leverage: 1:200

- Base currency: USD

- Market price: 0.6150

Step 1: Choose NZD/USD from the currency pairs section Step 2: Input 0.8 as your lot size Step 3: Set leverage to 1:200 Step 4: Select USD as your account currency Step 5: Confirm the displayed current price

Calculations show approximately $246 margin requirement for this 0.8-lot position. If NZD/USD advances to 0.6200 (50 pips higher), your profit equals $400. A decline to 0.6100 (50 pips lower) results in a $400 loss.

These precise figures help determine whether the trade aligns with your risk tolerance and profit expectations.

Common Mistakes to Avoid

Calculation mistakes drain trading accounts and create unnecessary losses. Recognizing these frequent errors protects your capital and improves overall trading performance.

- Incorrect leverage assumptions create the most significant problems. Traders often input maximum available leverage rather than their actual account leverage, producing unrealistic margin calculations. Always verify your leverage matches your account specifications.

- Overlooking session-based spread changes can invalidate cost projections. European session spreads often differ from Asian or American session spreads. The calculator uses current spreads, but actual costs may vary across trading sessions.

- Ignoring position interdependence when managing multiple trades can multiply your risk exposure beyond individual calculations. Trading USD/CHF and EUR/USD simultaneously doubles your dollar exposure, even when each position appears manageable separately.

- Disregarding news event impacts on spreads and execution can alter your expected trading costs significantly. High-impact economic releases often widen spreads temporarily, affecting your actual entry and exit prices.

Address these issues by carefully verifying all inputs, considering current market dynamics, and accounting for potential execution variations during volatile periods.

ZAR Account Compatibility

The calculator provides comprehensive support for South African Rand accounts with seamless currency integration. All calculations automatically convert to ZAR using current interbank exchange rates.

Exchange rate updates occur continuously throughout trading sessions to ensure accuracy. The system refreshes ZAR conversion rates multiple times per hour during active market periods for maximum precision.

South African interest rate differentials receive special consideration in swap calculations due to the unique monetary policy environment. The calculator incorporates these factors for accurate overnight cost estimates.

How Exness Calculator Helps South African Traders

- Native ZAR integration: All calculations display in South African Rand without requiring manual currency conversions

- Precision risk management: Understand exact margin needs in local currency to prevent over-leveraging and account damage

- Live market rates: Continuous exchange rate updates ensure calculations reflect current market realities

- Regulatory compliance: Maintain position sizes within regulatory limits through accurate ZAR equivalent calculations

- Full cost disclosure: View complete trading expenses including overnight fees converted to Rand for transparency

- Cross-platform access: Calculate requirements from desktop, tablet, or smartphone with identical functionality

- Market diversity: Handle calculations for local and international instruments popular with South African investors

FAQs

What is the Exness Calculator used for?

This calculator computes exact margin needs, profit projections, and all associated trading costs before position entry. It handles every tradeable instrument and converts results to your account currency, eliminating uncertainty from trade planning and execution decisions.