What Is Leverage in Exness?

Leverage lets you trade with more money than you actually have in your account. It’s like getting a loan from your broker to make bigger trades.

Here’s how it works. With 1:100 leverage, your $100 can control a $10,000 trade. The Exness leverage 1:2000 takes this further – that same $100 now controls $200,000 worth of currency.

The bigger the leverage number, the less money you need to hold a position. A standard forex lot usually costs $100,000. With 1:500 leverage, you only need $200 to trade it. Bump that up to 1:1000, and you need just $100.

But here’s the catch. Big leverage means big risks too. A small price move against you can wipe out your account fast. That 1% market shift hits much harder when you’re leveraged up.

Most brokers stick to 1:500 maximum. Exness goes way beyond this with their unlimited option.

Exness Unlimited Leverage – Rules and Conditions

The Exness unlimited leverage feature removes all the normal limits. You can open trades with almost no money down. Sounds amazing, but getting access isn’t automatic.

With unlimited leverage active, you might need just $1 to open a standard lot position. The system doesn’t use the normal ratios anymore. Instead, it calculates margins based on your account size and current trades.

Your account still has limits though. The broker watches your total risk and stops you from going overboard. When things get too risky, new trades get blocked automatically.

The stop-out rules stay the same. Hit 20% equity and positions start closing whether you want them to or not. This keeps your account from going negative.

Getting unlimited leverage takes some work:

- Complete account verification with proper documents

- Make at least 10 real trades first

- Keep minimum $1,000 in your account

- Clean trading record with no major issues

- Accept extra risk warnings

- Meet your country’s trading rules

The approval process usually takes 1-2 days. Each application gets checked manually to make sure everything’s in order.

Brand new accounts can’t get unlimited access right away. You need to trade normally first to prove you understand the risks.

Exness uses different leverage levels depending on your experience and account type. Most traders start with 1:1000, which gives plenty of trading power for most strategies.

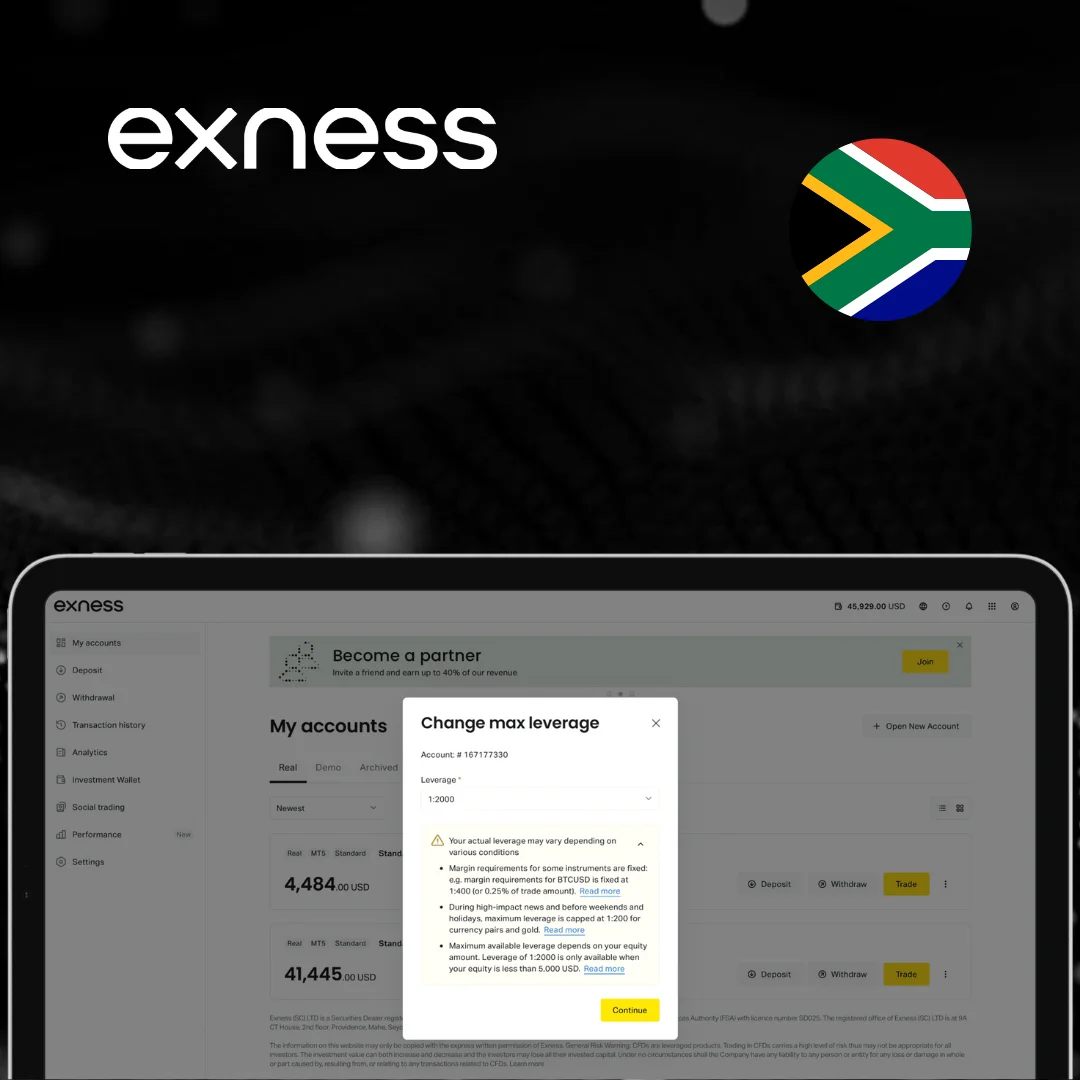

The Exness leverage 1:2000 comes next. This doubles your buying power compared to 1:1000. You need some trading history to unlock this level.

During crazy market times, these limits might drop temporarily. The broker does this to protect everyone when volatility spikes.

Different currency pairs might have different maximum leverage too. Major pairs usually get the highest ratios.

Account Types and Their Max Leverage

Standard accounts give you 1:1000 leverage right from the start. This works fine for most people getting into forex trading.

Raw Spread accounts have the same leverage limits as Standard ones. The difference is in the spreads, not the leverage available.

Zero accounts cap out at 1:500 for most pairs. The trade-off is you get incredibly tight spreads instead of higher leverage.

Pro accounts for experienced traders can jump straight to 1:2000. These accounts also qualify for unlimited leverage faster than regular ones.

Cent accounts use tiny lot sizes, so the leverage works differently. The numbers look similar but the actual risk is much smaller per trade.

How to Adjust Leverage in Your Account

Changing your leverage is pretty straightforward. Log into your Exness Personal Area and find your trading accounts section.

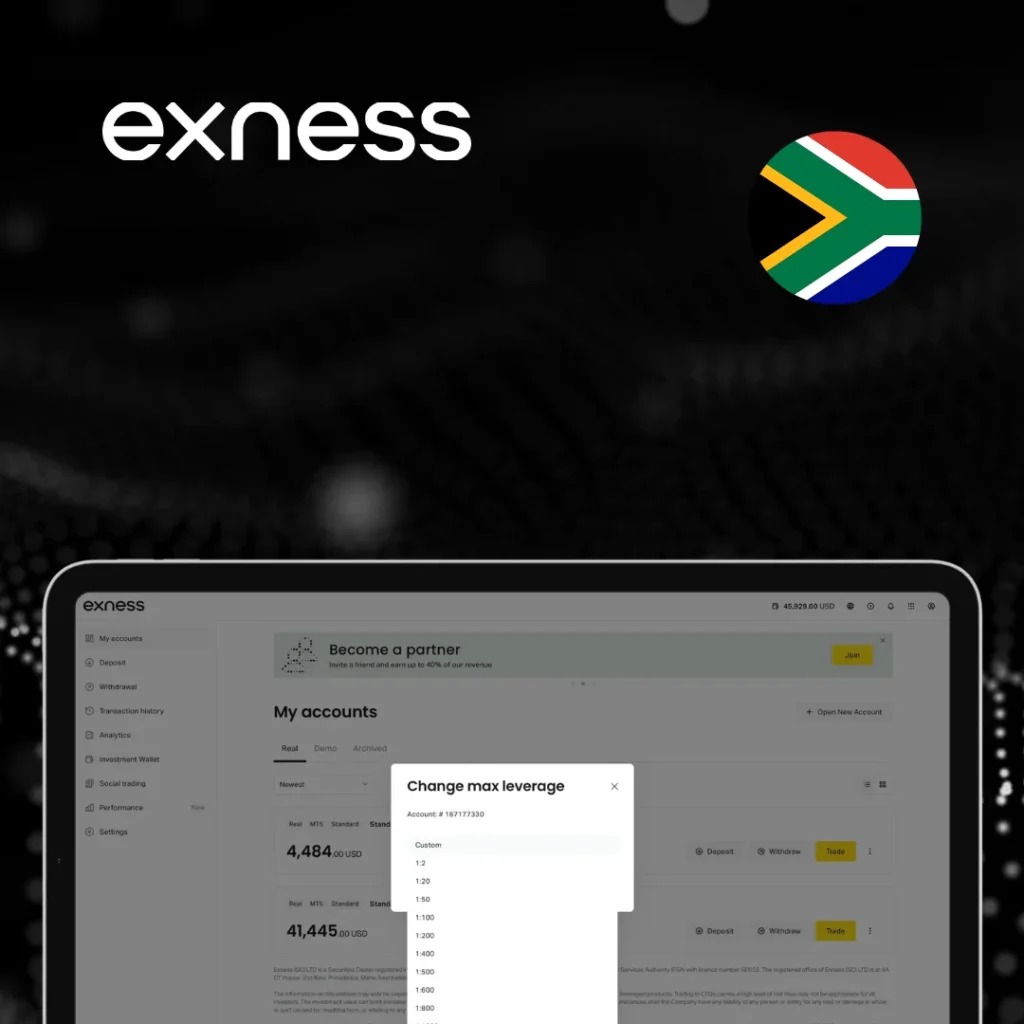

Click on the account you want to modify. Look for the settings or edit button. The leverage option should be right there with other account details. Pick your new leverage from the dropdown menu. Only options you qualify for will show up. If you want higher leverage, meet the requirements first. Changes happen immediately for new trades. Old positions keep their original leverage until you close them. This prevents margin calls from sudden changes.

Be careful when reducing leverage if you have open trades. The system won’t let you make changes that would trigger immediate margin calls. Higher leverage means less margin needed for each trade. But it also means bigger potential losses. Always calculate the impact before making changes.

Benefits of Using Exness App in South Africa

Big leverage can make you rich fast or broke even faster. Every trader needs to understand what they’re getting into.

Good things about high leverage:

- Trade bigger with less money in your account

- Make more profit when you guess right

- Use leftover cash for other trades

- Get into expensive markets you couldn’t afford before

- Spread risk across more currency pairs

- Earn decent money from tiny price moves

Bad things that can happen:

- Lose money just as fast as you make it

- Get margin calls before you know what hit you

- Stress levels go through the roof

- Entire account disappears in minutes

- Start making too many trades because it’s cheap

- Takes forever to recover from big losses

Most beginners pick the highest leverage and wonder why their money vanishes. Smart traders use it when it makes sense, not just because they can.

Leverage Settings for South African Traders

SA traders don’t face any special restrictions on leverage. You get the same options as traders everywhere else.

South African rules allow high leverage trading. No extra hoops to jump through or paperwork to file. Your location doesn’t block access to any Exness leverage features.

Banking from SA works fine with Exness. Deposit and withdraw in Rand without problems. The broker handles currency conversion automatically when you trade.

Your trading schedule works well too. SA time zones let you catch both European morning action and Asian evening sessions. More trading opportunities means more chances to use leverage effectively.

Leverage Availability for ZAR Accounts

ZAR accounts work exactly like dollar accounts for leverage. Same rules, same maximum ratios, same qualification process. Setting up a ZAR account is easy. Deposit Rand, start trading, change leverage settings whenever you want. The currency doesn’t matter for any of the leverage features.

When you trade, the system converts your Rand to whatever currency pair you’re buying. Margin calculations stay the same. Leverage ratios don’t change. ZAR accounts save you money on deposits. No conversion fees when you send Rand from your local bank. Withdrawals come back in Rand too. Exness unlimited leverage works for ZAR accounts. Currency choice doesn’t affect qualification or access to any leverage tier.

FAQs

What is the maximum leverage at Exness?

Unlimited leverage is the highest option for qualified accounts. Before that, you can get Exness leverage 1:2000 as the top fixed ratio. New traders usually start at 1:1000 and work up by trading regularly and meeting the broker’s requirements.