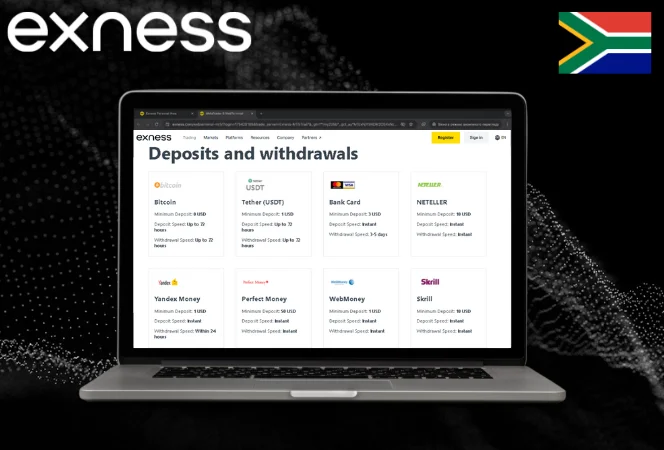

Supported Deposit Methods in South Africa

Exness provides traders in South Africa with several deposit methods that are reliable and widely used across the region. All deposit transactions are processed through the Personal Area, and most are completed within minutes.

Here are the commonly available options:

| Deposit Method | Processing Time | Minimum Deposit | Fee Charged by Exness |

| Instant Bank Transfer | Instant to a few mins | From 1 USD | No |

| Skrill | Instant | From 10 USD | No |

| Neteller | Instant | From 10 USD | No |

| Bank Cards (Visa/MasterCard) | Instant to 1 hour | From 3 USD | No |

| Crypto Wallets | 3–60 minutes | Varies by asset | No |

💡 Note: All deposits must be made from accounts owned by the trader. Third-party transfers are not accepted.

Each method is subject to currency conversion if not in USD or ZAR, and rates are determined by the payment system or your bank.

Supported Withdrawal Methods in South Africa

Withdrawals from Exness are typically processed using the same method used for deposits. This is a standard compliance procedure that helps prevent fraud and maintains account security.

Here’s a breakdown of withdrawal methods for South African users:

| Withdrawal Method | Processing Time | Minimum Amount | Fee Charged by Exness |

| Instant Bank Transfer | Usually Instant | From 2 USD | No |

| Skrill | Instant | From 10 USD | No |

| Neteller | Instant | From 10 USD | No |

| Bank Cards | 3–5 business days | Up to deposit amount | No |

| Crypto Wallets | Up to 72 hours | Varies by asset | No |

🔒 Exness uses automatic withdrawal processing for many payment systems. In most cases, funds are transferred within seconds.

However, actual times may depend on the payment provider or banking institution.

Verification Requirements for Payments

Before making a deposit or requesting a withdrawal, Exness requires users to verify their identity and account ownership. This is part of a broader compliance effort to meet global standards for anti-money laundering and client protection.

Required documents

- Identity document: Valid national ID or passport

- Proof of residence: Utility bill, bank statement, or government letter issued within the last 90 days

These documents must be submitted through the Personal Area, and account verification is usually completed within a few business days. Payment operations may be restricted until this step is completed. In some cases, proof of payment account ownership may also be requested — for example, a screenshot or bank statement showing your name and account number.

Common Payment Issues and Troubleshooting

Even though most payments go through without issues, traders may occasionally face delays or rejections. Here’s how to approach the most frequent problems:

Delayed transactions

Transactions marked as “processing” for longer than expected may be caused by:

- Technical issues with the payment provider

- Internet connectivity problems during submission

- Temporary banking network delays

Tip: Always check the Transaction History in your Personal Area to see the status. If the status hasn’t changed for more than one hour (for instant methods), it may be time to contact support.

Rejected deposits or withdrawals

Here are some typical reasons a payment might be declined:

| Reason | Suggested Action |

| Deposit amount below minimum | Check and retry with the correct minimum amount |

| Mismatched account holder name | Use a payment account registered in your own name |

| Incomplete verification | Upload and verify the required documents |

| Exceeded card withdrawal limit | Ensure the full deposit amount has been withdrawn before attempting to withdraw profits |

| Incorrect account details | Double-check account number and payment info |

A rejected transaction will usually show an error message in your Personal Area under the transaction history tab.

How to get support

If you’re unable to resolve a payment issue on your own, here’s how to reach the Exness support team:

- Live Chat: Available 24/7 via the website or Personal Area

- Help Center: Search for common payment-related issues

- Email: For document submission or follow-up (no unofficial addresses)

When contacting support, have the following details ready:

- Trading account number

- Payment method used

- Approximate transaction amount

- Date and time of the transaction

This helps speed up resolution and avoids unnecessary delays.

How to Choose the Best Payment Option for You

Choosing the right payment method on Exness depends on a few key factors. Speed, convenience, security, and fees all play a role in determining which option suits your trading strategy and lifestyle.

1. Processing Speed

If fast access to funds is a priority, choose instant bank transfers, Skrill, or Neteller. These options typically process within seconds, both for deposits and withdrawals.

| Method | Typical Speed | Best For |

| Skrill / Neteller | Instant | Active daily traders |

| Bank Cards | 3–5 days | Users with limited e-wallet access |

| Crypto Wallets | 10–60 mins | Traders using crypto assets |

| Bank Transfer | Instant | Local funding and ZAR accounts |

2. Ease of Use

Some traders prefer sticking to methods they already use for online payments or banking. For example:

- Bank Cards are familiar to most and easy to use.

- Skrill and Neteller work well for those managing multiple wallets.

- Crypto wallets may be suitable for those already trading digital assets.

3. Withdrawal Flexibility

Always choose a deposit method that also supports withdrawals, to avoid delays caused by switching between systems. Exness usually requires withdrawals to follow the deposit method used.

4. Currency Compatibility

ZAR-based methods reduce conversion costs. If your base currency is in USD or another major currency, check if your bank or wallet applies any FX conversion fees before depositing.

5. Security and Privacy

Exness encrypts all payment data and adheres to PCI DSS standards. Still, you should:

- Use 2FA on your Personal Area

- Avoid using shared or public networks when making transactions

- Only use payment accounts in your name

Frequently Asked Questions

Can I use someone else’s bank account or card to fund my account?

No. All deposits must come from accounts in your name. Using third-party details will result in the transaction being rejected.